How advanced investors maximise capital growth & ROI

Advanced investors understand that not all investment properties are created ‘equal’ and based on this knowledge, they will select properties that provide higher capital growth, have lower on-going costs and ultimately reward them with a much higher return on investment (ROI).

In this article, we will explain how investors can achieve this result with a proper understanding of a property cycle, and by taking advantage of it.

Australian real estate is often preferred as a low-risk way to make money for the long term. The bulk of the return is usually in capital gain, and rental income is merely used to cover some (or all) of the on-going holding costs like a mortgage.

Such properties, often referred to as ‘mature’ properties are generally located in the suburbs and are subject to ‘natural growth’ patterns.

What is a ‘natural growth’ pattern?

A ‘natural growth’ cycle sees a property double in value. Over time the pattern is typically cyclical in nature, much like the seasons. The cycle moves from growth for 2-3 years and then flattens off for the rest of the cycle. Natural property cycles are usually 7-10 years, with a long-term average of 8 years per cycle – this is why it is so important to hold a property for a least one full cycle. The length of a property cycle can vary with inflation, interest rates, immigration levels, employment, location, price point, property type and many other factors that can make the property cycle shorter or longer than the average.

Advanced investors look a little deeper and understand there is not just one Australian property market. In fact, the market varies not only from city to city but also from suburb to suburb within that city. Even property types within a suburb display different patterns.

Advanced investors are focussed on optimising all the factors that play a part in a property’s ‘natural growth’. Plus, they also understand the opportunities that ‘man-made’ growth offers in creating even higher returns.

What is man-made growth, and how to take advantage of it?

Sophisticated developers are often able to create ‘man-made’ growth. In simplified terms, this is how it works:

- Developer buys a huge land parcel

- They allocate the first set of stages (for example each stage containing 15 land blocks), which are generally largest in size and sold at the lowest possible price.

- Over time, the new stages are released, which are slightly smaller in size with pricing continually pushed up by a small amount.

These larger scale land developments can continue for years, or even decades. So, getting in early on one of these large developments can almost guarantee capital growth in the long term, as the developer will implement every strategy they can to push the price value of the land block.

This can result in much higher growth rates and capital profits for the investor, even if the rest of the overall market for that city is growing slowly (or is even flat at the time). Once a development is fully sold out with no more land releases by the developer, only then will the development revert to standard ‘natural growth cycle’ for that area.

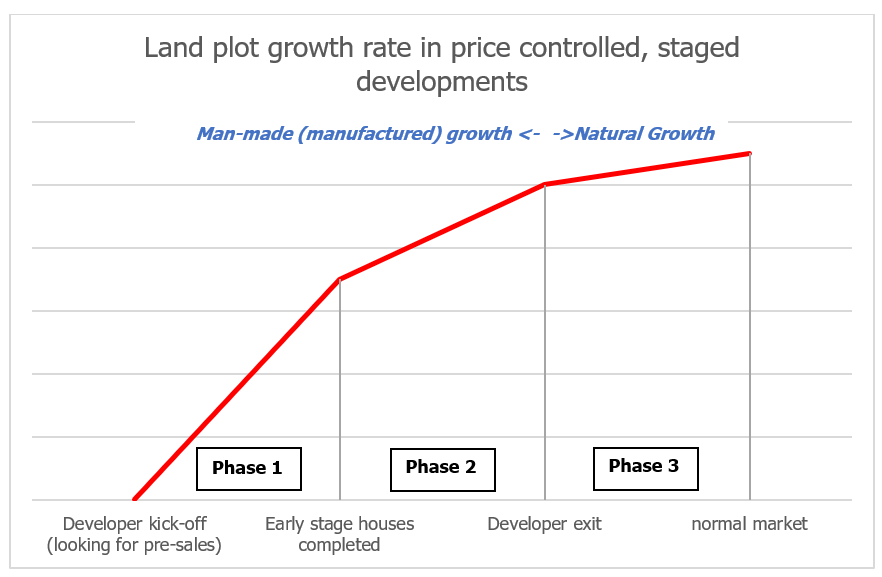

The graphic below illustrates the ‘man made/ manufactured’ (phase 1 & 2) vs ‘natural growth’ (phase 3):-

In the above diagram, most owner-occupiers (the bulk of the buyers for new homes in estates) will buy during phase 2, when they can see roads, amenity and newly built homes, plus as they are usually wanting to start a family in their own soon to be built home, they are unwilling to wait a long time for their new block. Therefore, they are often looking for titled (or soon to be titled) blocks of land.

Phase 1 is characterised by the developer spending big on marketing to create sales momentum – this is when the land blocks sizes are the biggest and price the lowest. In some developments a sophisticated developer may even allow some investors to purchase very early in phase 1 to assist with ‘pre-sales’. This is a rare opportunity that advanced investors look for, often allowing them to secure a block with as little as a 10% deposit (giving them a very high ROI) and capture its capital growth for years without a mortgage or virtually any other costs.

Once the existing property is in phase 3 i.e., it’s a mature property in a well-established suburb slowing down to just ‘natural growth’ and a mortgage (and potentially land tax too), they sell this one and use some of the profits to secure a new property in phase 1 in another upcoming development. The new property in phase 1 is once again secured with as little as a 10% deposit, no mortgage, and no land tax. Yet it will capture all of the accelerated capital growth that occurs in this phase usually providing a very high ROI.

Resimax Group specialises in masterplanned price controlled staged developments in high growth areas. Its in-house builder, Tick Homes, specialise in efficiently building stylish, modern homes of the highest quality in Resimax estates. Customers buying through RGI can benefit from our unique ‘5/10/20 Guarantee’ of 5yrs capital protection, 10yrs rent guarantee, and 20yrs structural guarantee on Tick homes. RGI members receive early notification of projects well before public release.

Disclaimer: This article is for general information purposes only and should not be taken as advice. Always seek professional advice from suitably qualified professionals familiar with your situation and goals.

—————————————————–

For lots of other great content, head over to the Resimax Group Investor website: https://resimaxgroupinvestor.com/

Not a member yet? No problem, join for free to get member access to all our webinars, articles and everything property.

—————————————————–

Steven Molnar is Head of Research and Education for Resimax group. With over 25+ years in property and finance in Australia and internationally, he brings a unique perspective to each interview with interesting guests and property insights. Resimax group is one of Australia’s largest private property developers, Resimax Group Investor is headquartered in Kuala Lumpur MY.

——————————————————–