Apartments or Houses – Where’s the New World Heading?

What a difference a year makes!

Back in the opening months of 2020, millions of people started their working day with a long commute to a city office, bought a coffee between the station and their desk and settled in for eight hours of working for the company at the company’s premises.

Suddenly all this changed. Governments enforced a Work From Home (‘WFH’) order and the CBD’s of countless cities shut down. This new experience of working from home not only changed the working habits of millions of office workers it also changed their perceptions of where and how they chose to live and work.

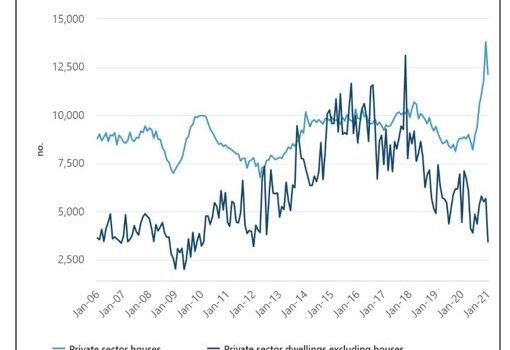

Now, after a year of the WFH revolution, the impacts are being felt far and wide, especially in how property markets are responding. The graph below from the Australian Bureau of Statistics in January 2021 shows two most interesting trend lines.

- The continuing downward trend in numbers of new approvals for ‘Private sector dwellings excluding houses’. In other words, for non-landed properties (flats and apartment).

- The dramatic spike upwards over the past year for ‘Private sector houses’ building approvals. That is, landed bungalows including houses and townhouses.

The trends can be directly related to two very significant, and changing, factors.

- With borders closed, CBD’s empty and demand falling, fewer and fewer people are seeking to live in inner urban and central city locations, which predominantly means apartments.

- On the other hand, the newly discovered lifestyle benefits (plus WFH technologies, like Zoom) including less commuting, more time with family, open space and less crowding are all contributing significantly to the huge demand for new housing in landed suburban areas.

The demand for these new landed properties is best illustrated by the fact that house price values in newer outer urban housing estates have not only resisted the Covid-19 price falls, but have in fact, continued to escalate in value through 2020 and now into 2021.

Non-landed properties, like inner city apartments, on the other hand, have slumped in value with decreasing demand, high vacancy rates and falling new dwelling approvals, as illustrated in the chart.

The future is becoming clear. More and more people are resisting a return to the ‘old ways’ of commuting to the crowded inner-city workplaces and are choosing (because they are able to) the new-found freedom, technology-enabled, of working from home in a house that they are renting, buying or building away from the old inner city.