The Next Evolution in Property Investment Has Arrived

Access Double-Digit Returns Without Buying Property. Zero Property Issue. No ABSD.

Singapore’s elite investors are earning 10-12% annually through this exclusive property fund

Featured In:

Why Smart Money is Flowing To This Property Fund

- The traditional property investment playbook is broken.

- Unpredictable housing markets.

- Skyrocketing costs and taxes.

- Tenant headaches.

- Management fees eating into your returns.

That’s why hundreds of savvy Singapore investors have already secured their position in our exclusive property fund.

The Numbers Don’t Lie:

✓ Minimum 10-12% ROI net per annum

✓ Start investing from as little as $140,000 SGD

✓ Zero ongoing fees or hidden costs

✓ Proven track record: Over 23,000 lots in portfolio

✓ Listed with Monetary Authority of Singapore (MAS) & ASIC

Learn more at our live session at the InterContinental, Singapore:

Fri 29 Nov, 7pm | Sat 30 Nov, 2pm | Sun 1 Dec, 2pm

Don’t Miss This Opportunity. Lock In Your Slot!

Fri 29 Nov, 7pm | Sat 30 Nov, 2pm | Sun 1 Dec, 2pm

InterContinental, Singapore

** Limited to Accredited Investors Only

This exclusive briefing is strictly limited to accredited investors who meet one of these criteria due to MAS regulations:

(A) Whose net personal assets exceed in value AU$2 million (or its equivalent in a foreign currency) or such other amount as the Authority may prescribe in place of the first amount;

(B) Whose financial assets (net of any related liabilities) exceed in value AU$1 million (or its equivalent in a foreign currency);

(C) Whose income in the preceding 12 months is not less than AU$300,000 (or its equivalent in a foreign currency).

Click here for full terms & conditions

If you’re unsure whether you’re an Accredited Investor, just fill up the form. A member of our team will reach out to help you with the process.

Exclusive 1 Hour Private Session for Accredited Investors

In this private session, you’ll discover:

-

How to generate passive income without the headaches that come with owning a property

-

Why traditional property investment strategies are failing in today's market

-

The unique market conditions creating this opportunity

-

How our Build-to-Rent Fund consistently delivers 10-12% returns

This is Not Another Property Investment Scheme

You’re not buying property. You’re tapping into the expertise of one of Australia’s leading property development firms through a carefully structured fund.

✓ Resimax is a $20B developer, not just a fund manager.

✓ We control the entire value chain – from land to tenancy – so this requires zero management on your part

✓ We’re the only major developer offering land-and-house Build-to-Rent in Melbourne

✓ Our scale allows us to offer above-market returns others can’t match

✓ Regulated by MAS & ASIC. Backed by financial houses like Allianz.

Our development partners:

Exclusive 1 Hour Private Session for Accredited Investors

In this private session, you’ll discover:

- How to generate substantial passive income without the headaches that come with owning a property

- Why traditional property investment strategies are failing in today’s market

- The unique market conditions creating this opportunity

- How our Build-to-Rent Fund consistently delivers 10-12% returns

What investors are saying

“We started investing with Resimax more than 10 years ago… all these years Resimax has always delivered their promise at the price that was promised to us. Reason why we moved over from buying actual properties to the BTR fund is that the fund allows us to invest in Australian properties without being ripped off by Victorian government”.

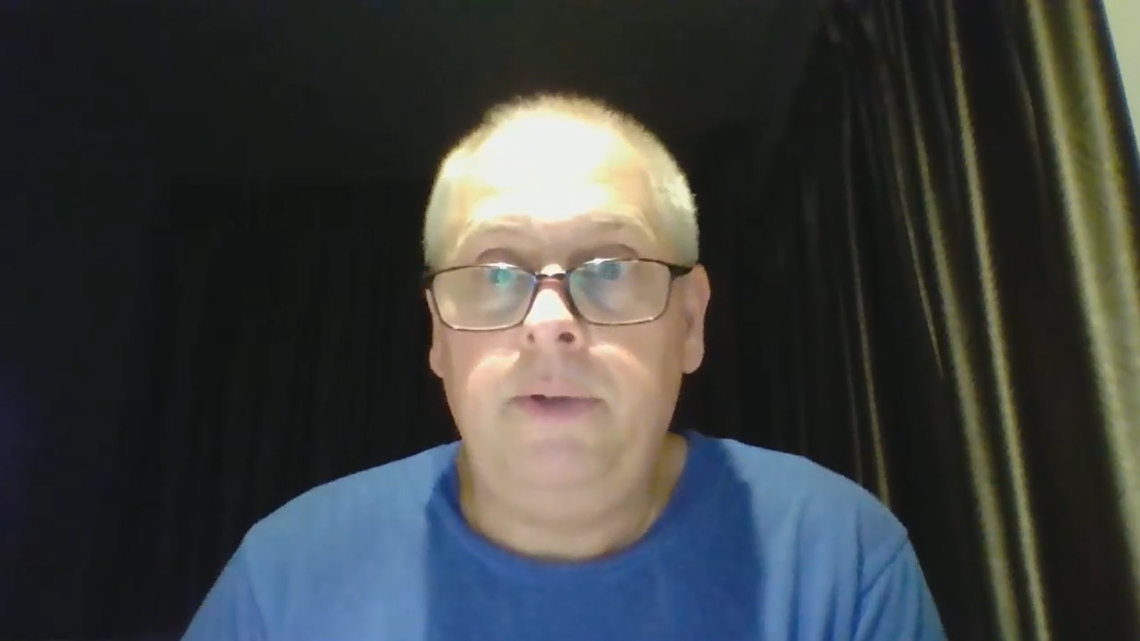

– Arjen De Regt, Investor

“This year when the property market is a bit unsettled, Resimax came up with the BTR Fund for investors. This offers money returns of 0 – 12%. I have invested in this fund and received the money returns as promised. This is suitable for investors who are looking for returns above 10%”

– Michael Seow, Investor

Resimax Group has the unique ability to offer opportunities like no other property developer. They deliver what they promise and I can trust my money with them.

I have invested with Resimax Group for many years now. The BTR Fund is a very creative opportunity for investors, especially at a time when the property market is uncertain. It is a great way to generate solid returns and continue on the path of securing our financial future.

The BTR fund has been a great opportunity to continue investing in the property market without the added taxes and expenses such as FIRB, mortgage, maintenance etc. I respect that the investment is secured against real property and I have been enjoying the returns since investing earlier this year.

Event Details

Date & Time:

Fri 29 Nov, 7pm | Sat 30 Nov, 2pm | Sun 1 Dec, 2pm

Location:

InterContinental, Singapore

80 Middle Rd, Singapore 188966

Location map: https://maps.app.goo.gl/H9nXPoNiqK58vXE18

The information contained on this website is general information relating to the seminar only. Investors who progress to consideration of further documentation or information will be provided with the Terms and Conditions relating to this opportunity.

This seminar is only intended for accredited investors and institutional investors, as defined in the Securities and Futures Act 2001 of Singapore. By registering for this event, you confirm that you are an accredited investor or institutional investor, as defined in the Securities and Futures Act 2001 of Singapore. Accredited investors and institutional investors must seek their own advice.

This document has not been reviewed by the Monetary Authority of Singapore. This document is for informational purposes only and does not constitute any offer to sell or a solicitation of any offer to buy any capital markets products. This document does not contain, and the reader should not treat the contents of in [this website] as, advice relating to legal, tax, accounting or investment matters and that the reader is advised to consult their own professional advisers. The information in this document is accurate as at 11 September, 2024 and Resimax Group accepts no legal liability in respect of the information or for its accuracy or completeness.